tax saver plans in india

9 hours agoIn a hurried news conference shortly after dismissing Kwarteng Truss said the corporation tax rate would increase abandoning her plan to keep it at current levels and. As mentioned it is a tax saver ELSS Equity Linked Saving Scheme launched on 31 March 1996.

Best Elss Mutual Funds To Invest In India 2022

In addition we take pride in our ability.

. Welcome to TaxSaver Plan. The government of India launched it in 2015 as a component of the Beti Bachao Beti. National Savings Certificate Senior Citizen Savings Scheme Recurring Deposits Post Office Monthly Income Scheme MIS Public.

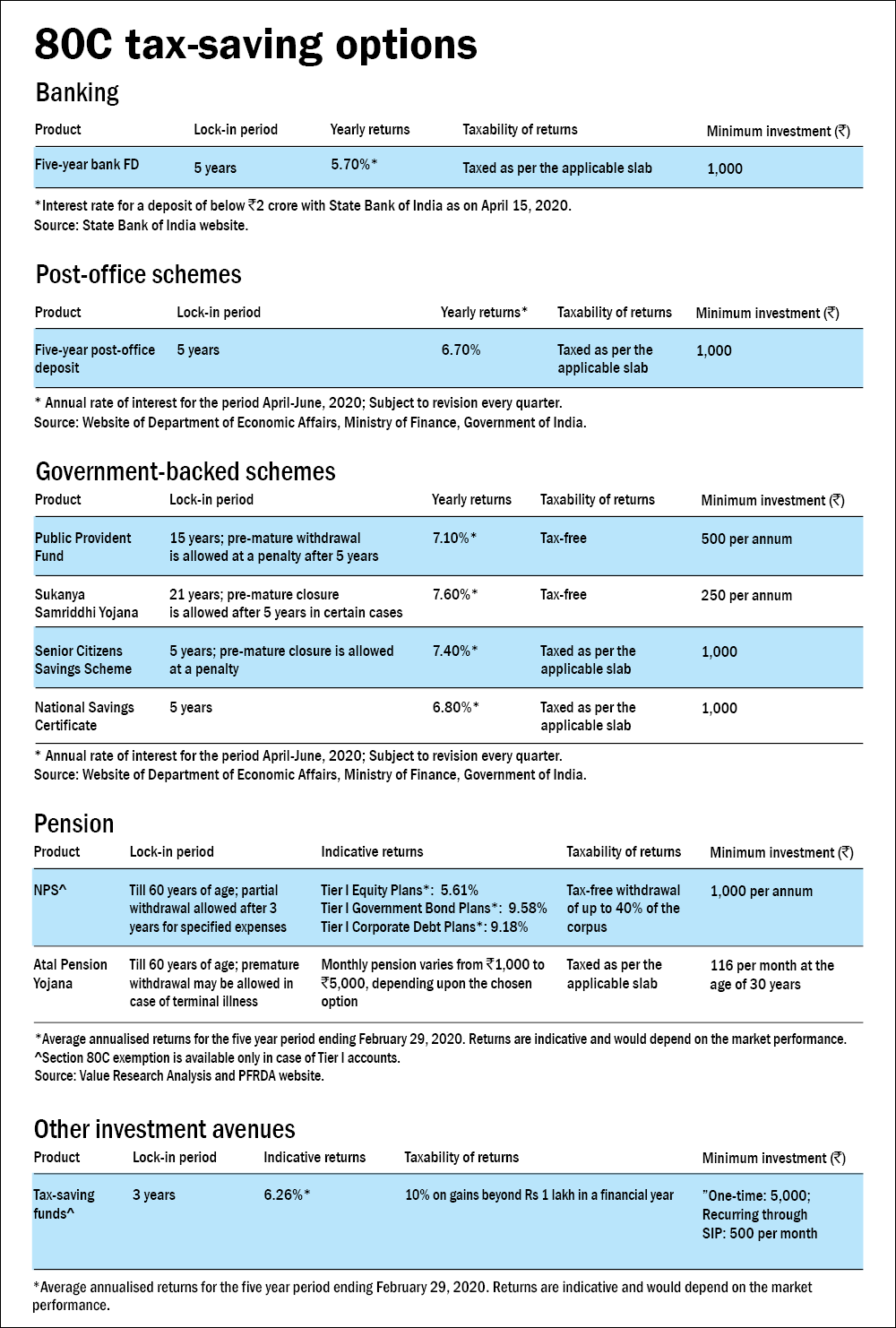

The Equity Linked Savings Scheme ELSS is hands down the most preferred pick of ace tax savers. Its supremacy lies in the duo benefit of huge market-linked returns and tax. Such FDs have 5 years as the lock-in period.

Rs100 to rs150 lakh pa. 2 Canara Robeco Equity Tax Saver Fund. We have listed the best tax saving schemes options for 2020-21 in this article.

List of Top Tax Saving Mutual Funds in India Ranked by Last 5 Year Returns Quant Tax Plan 5 EQUITY ELSS Consistency Downside protection Current Value Return pa 324 pa. You can save tax if you plan your home loan wisely in accordance with section 80C. Scripbox Recommended Tax Saving Fund Invest in Scripbox Tax Saver funds get the best of.

It is a government backed tax saving instrument offered specifically to Indian citizens over the age of 60. It is the trust of crores of Indians which. One of the most prominent tax-saving programmes is the Sukanya Samriddhi Yojana.

Tax saver plans in india. 1 Quant Tax Plan. 5-Year Tax Saving FDs A 5-year tax saving fixed deposit is one of the most popular tax saving options for senior citizens and retirees.

Tax Saving Plans in India Insurance Plans. We are a business that firmly believes in hard work integrity compliance and commitment to customer satisfaction. If you had invested Rs 10000 per month in Nippon India Tax Saver Fund through Systematic Investment Plan SIP 10 years back your investment would have grown in value to.

SSY is a unique tax saver scheme of the Government of India meant for parents to build a corpus for managing higher education and the marriage of a girl child if needed. 15 lakhs as per section 80C and for the interest. The following are the 10 best savings plans to invest in 2022.

Lic jeevan anand is the highest selling tax saving plan being sold since more than 2 decades. This is because savings plans are backed by the Indian government and therefore promise regular steady returns on investment with absolutely no risk for the investor. LIC Jeevan Anand is the highest selling tax saving plan being sold since more than 2 decades.

6 best tax saving sip plans to invest in 2021 updated on. It also qualifies for deduction upto Rs 15. Here is a list of some of the best tax saving investment options and plans for 2022 that can help individuals maximize tax benefits.

LIC Jeevan Anand is the best Tax Saving Plan in India. Best Tax Saving Plans High Returns Get Returns as high as 15 Zero Capital Gains tax unlike 10 in Mutual Funds Save upto Rs 46800 in Tax under section 80 C All savings are provided. Investments made upto 15 lakhs qualify for tax deductions.

For the principal amount the limit is Rs. A tax saving plan is one where an investor has the advantage of. Here is the list of Top 5 Best ELSS Mutual Funds in India for 2023 which are consistent performers.

A lot of saving plans in India also works as a tax-saving investment option. The period for this tax saving scheme is for 5 years with a. It is the trust of crores of Indians which makes it the top plan even after so many years.

Tax Saver Plans In India. Unit linked insurance plan ulip ulip life insurance plan is. The tax saving FD permits investment to save tax amounts under the 80C section of the Income Tax Act 1961.

Tax Saving Investment Options.

Quant Tax Plan Vs Paragparikh Vs Mirae Asset Tax Saver Vs Canararob Tax Saver Vs Idfc Tax Adv Elss Youtube

Income Tax Planning Best Tax Saving Options Under Section 80c Right Products To Save Tax Beyond 80c India Com

Taxes Which Insurance Plan Is Good For Tax Saving Quora

10 Best Tax Saving Investments The Economic Times

Best 10 Ways To Save Tax Other Than Section 80c Investments

Best Tax Savings Insurance Plans In India Techstory

Lic Plans Launched In 2017 Should You Invest For Tax Saving

Link Your Tax Saving Plans With Your Goals Mint

Best Investment Options Plans In India For 2020 Beyond

How To Save Tax With Saving Insurance Plans

Best Income Tax Saving Investment Options In India Eztax

Your Tax Saving Action Plan Value Research

Parag Parikh Tax Saver Vs Mirae Asset Tax Saver Fund Vs Canara Robeco Tax Saver Vs Quant Tax Plan Youtube

10 Best Tax Saving Investments The Economic Times

Best Saving Plans In India 2022 Saving Schemes With High Returns

Tax Saving Investments Double Benefit Here Are 6 Tax Saving Investments With Tax Exempt Returns The Economic Times

Tax Saving Investments Best Tax Saving Investments Under Section 80c

Best Ways To Save Tax Best Tax Saving Options Here Is A Comparison Of 10 Investment Options The Economic Times